Alright, folks, gather ‚round. So AAVE’s doing a little dance—more like a belly flop than a graceful pirouette—dropping 23% since July. Yeah, the price is crashing like my hopes at a buffet, but the ecosystem? It’s doing cartwheels!

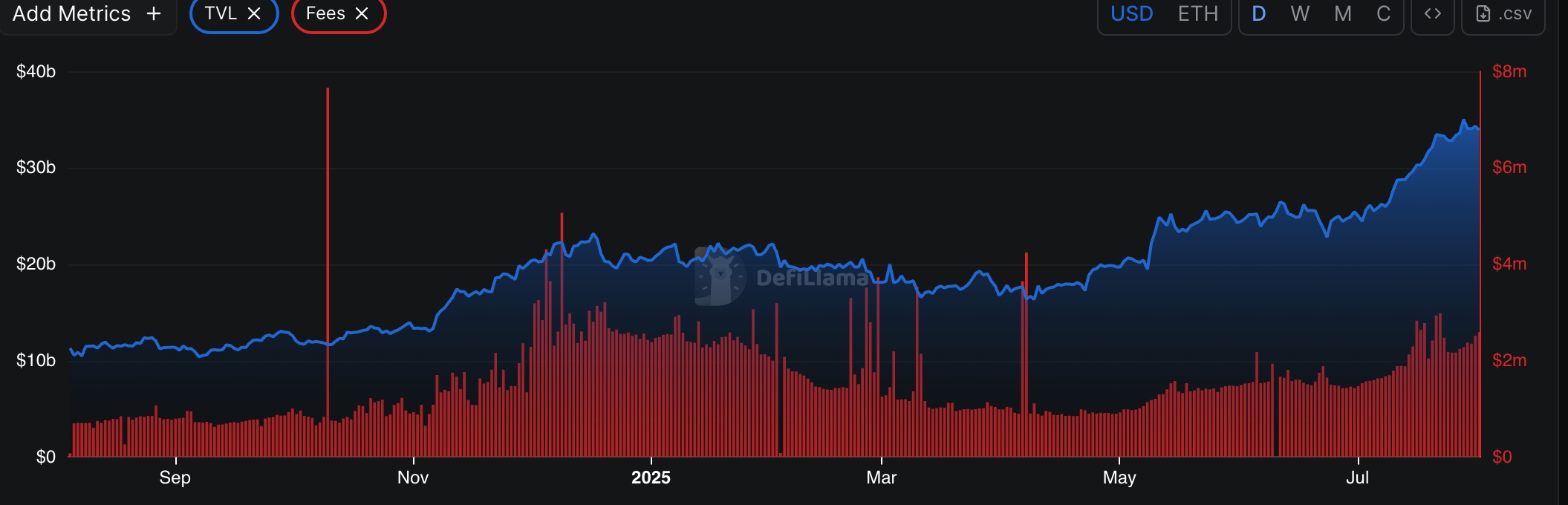

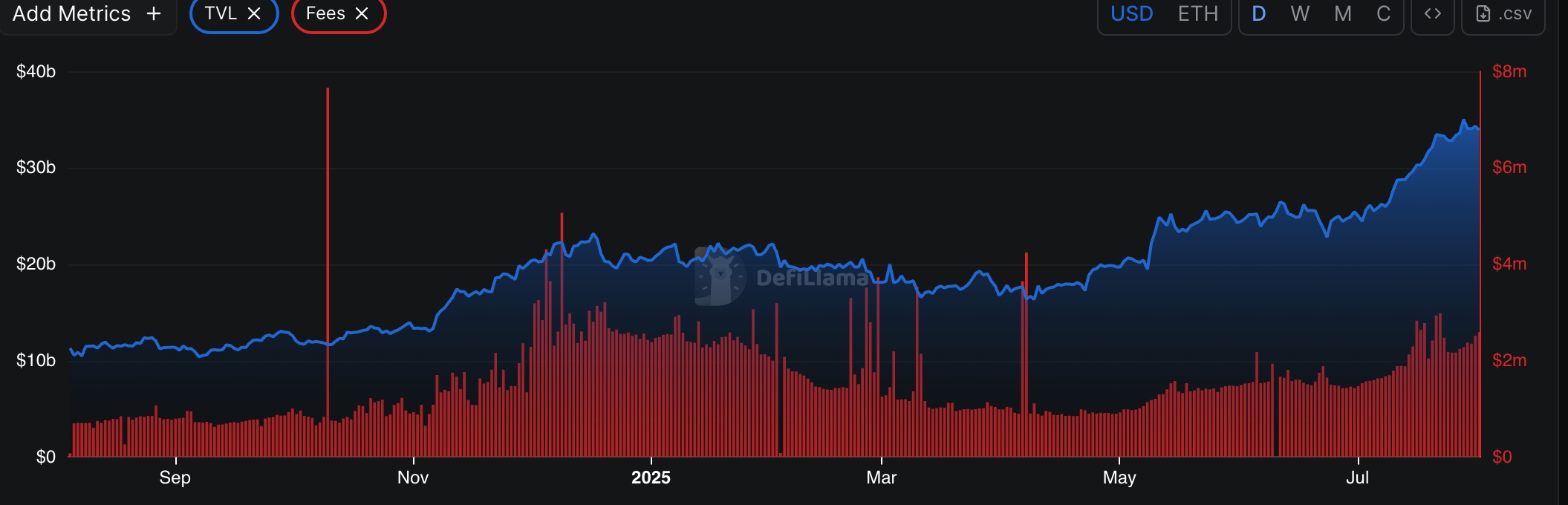

Now, hold onto your hats. Despite the slide, the total value locked is hitting a record—$35 billion! That’s more zeros than my bank account. Starting the year at $21 billion, so basically, they’re doing a magic trick—stuffing more assets into DeFi than I can hide snacks from my diet. And guess what? Ethena (ENA), the new kid on the block, just grew nearly $5 billion. That’s like putting a BOGO sale on digital assets.

Meanwhile, fees and revenue are skyrocketing. Over $783 million in fees in 12 months—that’s right, M-I-L-L-I-O-N. Their annual earnings? $47 million. Revenue? Over $110 million. I mean, if I could make that kind of cash without leaving my couch, I’d be doing handstands. Or at least a lazy wave.

TokenTerminal says deposits shot up 21% in July, active loans up by 25%—to a cool $20.5 billion. Monthly fees and revenue, like a rocket, up 49% and 85%. Basically, AAVE’s making bank, while its price is doing a „how low can you go“ routine. The daily chart? A mess—peaked at $337.25, then took a nosedive faster than my New Year’s resolutions. It’s below the 50 and 100-day moving averages, lurking around the $250 line, like a kid hiding from chores. The RSI? Approaching „oversold,“ so maybe it’s just tired or playing dead.

Schauen Sie, es sei denn. Oder, wissen Sie, schauen Sie einfach von der Seitenlinie aus und tun Sie vor, dass Sie verstehen, was los ist. Was auch immer passiert, es ist sicher unterhaltsamer als die jährliche Fischgeschichte meines Onkels.

Weiterlesen

- Goldpreis Prognose

- GBP MYR PROGNOSE

- EUR INR PROGNOSE

- KCS PROGNOSE. KCS Kryptowährung

- EUR ZAR PROGNOSE

- WLD PROGNOSE. WLD Kryptowährung

- EUR MYR PROGNOSE

- EUR JPY PROGNOSE

- Abacus Market: In einem Rauchwolke weggegangen – Betrug oder Spektakel? 😱

- Brent Prognose

2025-08-01 22:10